Is Intuit Quickbooks A Secure Website? Do They Respect Users’ Privacy?

Content

The right to data portability – You have the right to request that we transfer the data that we have collected to another organization, or directly to you, under certain conditions. The right to erasure – You have the right to request that we erase your personal data, under certain conditions. Thus, we are advising you to consult the respective Privacy Policies of these third-party ad servers for more detailed information. It may include their practices and instructions about how to opt-out of certain options. Sync your store data and connect other tools to unlock more automation features.

Why It’s Tough to Get Help Opting Out of Data Sharing – ConsumerReports.org

Why It’s Tough to Get Help Opting Out of Data Sharing.

Posted: Thu, 04 Feb 2021 08:00:00 GMT [source]

For Freelancers & Agencies Join our community for freelancers and agencies to unlock tools for managing clients and perks to grow your business. Drive traffic and boost sales with a marketing platform that seamlessly integrates with your store.

Marketing Preferences

Once this privacy policy is created, we will add a link to it on our home page or as a minimum, on the first significant page after entering our website. We use Avalara to manage sales tax calculations, tax liabilities and tax exemption certificates.

If you are a European resident, you have the right to access personal information we hold about you and to ask that your personal information be corrected, updated, or deleted. If you would like to exercise this right, please contact us through the contact information below. We use the Device Information that we collect to help us screen for potential risk and fraud , and more generally to improve and optimize our Site . The Intuit.fm iOS App does not collect any user data when installed or launched on your device. Wells Fargo supports a version of QuickBooks Desktop that is current or from the prior two years. Access supported software to determine if your version of QuickBooks software is retiring or has already retired. Request a live demo to see the many ways Glance can transform your customer experience.

Privacy Policy

You may request objection, restriction and portability rights by contacting us through the link provided in the “How to Contact Us” section for Brazil, below. You have the right to file a complaint with a supervisory authority about our collection and processing of your personal information. To make a request for access or deletion of your personal information, contact us through the link provided in the “How to Contact Us” section for Australia, below. We may provide opportunities for you to publicly post reviews, questions, comments, suggestions or other content, which may include personal information, such as your name or user name. Anything you share in a public forum is public, and you should think carefully before you decide to share. With appropriate controls, we may share information with third-parties, such as academic institutions, government and non-profit organizations, for research purposes or to publish academic or policy-related materials.

How secure is Intuit?

Your data is protected and private.

With password-protected login, firewall protected servers and the same encryption technology (128 bit SSL) used by the world’s top banks, we have the security elements in place to give you peace of mind.

Intuit is solely responsible for its content, product offerings, privacy, and security. Please refer to Intuit’s terms of use and privacy policy, which are located on Intuit’s website and are administered by Intuit. Yes, depending on the version of QuickBooks Desktop software, you can assign access levels and/or multiple users.

We Take Security Seriously

You may request to delete your personal information at any time through your account settings, through our privacy center or by contacting a customer support agent. We will retain your information in accordance with our records retention program and delete it at the end of the retention period. You may object to our processing of your personal information, including for marketing purposes, or ask us to restrict processing of your personal information. Finally, we may also share your Personal Information to comply with applicable laws and regulations, to respond to a subpoena, search warrant or other lawful request for information we receive, or to otherwise protect our rights. The purpose of the information is for analyzing trends, administering the site, tracking users’ movement on the website, and gathering demographic information.

- You may request objection, restriction and portability rights by contacting us through the link provided in the “How to Contact Us” section for Mexico, below.

- But these requirements were easily bypassed, as evidenced by a previous breach at Equifax’s employment division.

- We may amend this privacy policy at any time by posting the amended version on this site including the effective date of the amended version.

- To do this, visit your account settings or click on a link in the email you receive or contacting one of our customer support representatives.

Supplemental information and identity verification providers.Service providers who help us verify your identity, the specifics of your business and/or supplement the information you have provided and ensure the accuracy of your information. For example, we use third party service providers to validate your mailing address, phone number or provide additional details about your business. These providers may include, for example, your financial institution, telecommunications provider or email provider. When we act as a service provider, the privacy statement of the relevant Information Controller and our agreements with such business or entity will govern our processing of personal information. This Privacy Statement does not apply where Intuit processes personal information as a service provider on behalf of a customer or entity who acts as the data controller, for example, the customers of our professional tax software products. When we act as a service provider, the privacy statement of the relevant data controller and our agreements with such business or entity will govern our processing of such personal information. For example, we use third-party service providers to validate your mailing address, phone number or provide additional details about your business.

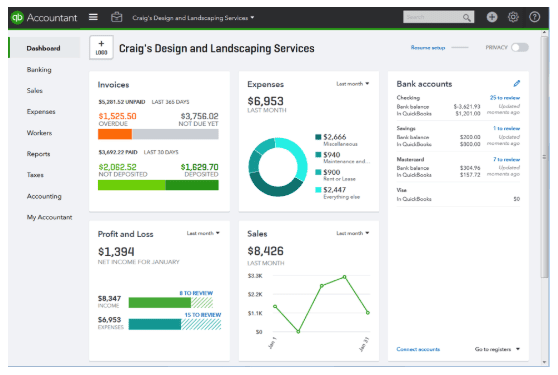

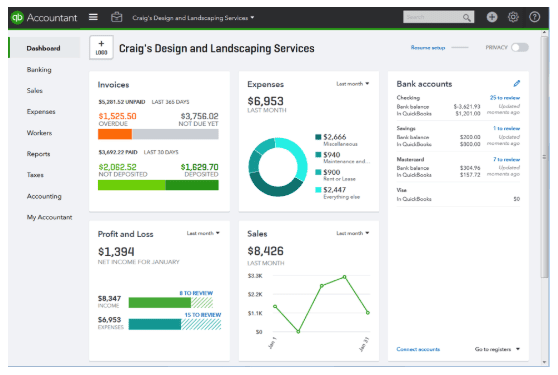

How Features In Quickbooks Online And Quickbooks Online Accountant Help Professionals Work With Business Clients

The legal basis for processing is consent and your affirmative action to enter into such contract with us and/or the purchase and delivery of the contract between you and us. If we make material changes to the way we process your personal information, we will notify you by posting a notice in our platform or on a community post, by sending you a notification or by other means consistent with applicable law. Except as necessary to provide intuit privacy policy you with tax preparation services or as authorized by law, we will not disclose your Tax Preparation information – including to Intuit’s affiliates and subsidiaries – unless you consent. Some experiences and services within our platform allow you to interact with an organization . If your access rights are amended by the owner or designated administrator, then you may lose access to the information that lives in the organization.

The other data controllers have their own obligations under applicable information privacy laws. Intuit is not responsible for the processing of other data controllers and you should contact them directly for questions on how they process your personal information and for exercising your privacy rights in relation to such processing. You can opt-out of having your contact information used for direct marketing. To do this, visit your account settings or click on a link in the email you receive or contacting one of our customer support representatives. You may request for us to delete your personal information by contacting us through the link provided in the “How to Contact Us” section for Mexico, below. When making a request, please provide a clear and precise description of the personal data you wish to delete/cancel or any other element that facilitates the location of your data. You have the right to request that we remove your personal information from our records or databases when you consider that it is not being used in accordance with the principles, duties, and obligations provided for in the applicable laws.

Intuit Privacy Shield Certification

In selling payroll data to Equifax, Intuit will be joining some of the world’s largest payroll providers. For example, ADP — the largest payroll software provider in the United States — has long shared payroll data with Equifax. This Statement of Privacy applies to and Informed System, Inc. and governs data collection and usage. For the purposes of this Privacy Policy, unless otherwise noted, all references to ISI include and ISI.

QuickBooks expert Dawn Brolin of RadioFree QuickBooks shares how moving her accounting practice to the cloud has helped her be more productive. Intuit President and CEO Brad Smith shares with Executive Editor Darren Root, CPA, an overview of the company’s strategy and new product releases at the Intuit VIP Summit. This Privacy Policy describes how your personal information is collected, used, and shared when you visit or make a purchase from cartqbook.com (the “Site”). Intuit.fm does not knowingly collect any Personal Identifiable Information from children under the age of 13. You may consult this list to find the Privacy Policy for each of the advertising partners of Intuit.fm.

Full statementfor complete details about the changes to our policy and to learn more about how we process personal information. We’ve added additional information about how we use data to provide you, your family, and/or your business with insights and recommendations. The controller of your personal data is Intuit Inc. whose contact details can be found in the “How to Contact Us” section below. If you are a resident of Mexico, you also have the right to withdraw your consent for our processing of your personal information by contacting us through the link provided in the “How to Contact Us” section for Mexico, below. You have the right to request the correction of your personal data if it is outdated, inaccurate, or incomplete .

Platform Features

If you contact us directly, we may receive additional information about you such as your name, email address, phone number, the contents of the message and/or attachments you may send us, and any other information you may choose to provide. Whether or not you give permission, Intuit can share some information — such as late or missed payments, or other defaults on your account — with “credit bureaus, consumer reporting agencies, and card associations,” according to its privacy policy.

For specific instructions on how to request a copy of your information, please see the section “Your information rights and choices” below. Communication providers & social networks.We or our third party service providers may collect information from email providers, communication providers and social networks, including to monitor public discussion about our brands.

The personal information that we receive about you depends on the context of your interactions with Intuit, how you configure your account and the choices that you make, including your privacy settings. Personal information that you provide may also depend upon what services or experiences you use, your location and applicable law. Learn more about the personal information we collect, how we use it, and your rights. QuickBooks also launched a new platform for product-based businesses, offers on-demand accounting experts, and has helped to democratize machine learning by adding it to the company’s offerings for the benefit of small businesses. At Intuit, we believe that you have rights to information that pertains to you, your household and/or your business. If another person has input or processed information in the Intuit Platform on behalf of you, your family or your business ,you may ask to receive a copy of your information, even if you do not have an account with us. To help protect privacy and the security of your information, you may be asked to provide additional information to verify your identity and/or ownership rights prior to receiving a copy of the information.

Balazs: The privacy policy at Intuit is your privacy policy. #gartenrcat

— JohnFontana (@JohnFontana) August 21, 2012

This Privacy Statement does not apply where Intuit processes personal information as a service provider on behalf of a customer or entity who acts as the Information Controller, for example, the customers of our professional tax software products. The landmark accreditation gives Australians greater control over how their financial and banking data is accessed and used and allows them to securely share it with accredited third parties. Your rights under data protection laws include the right to access, erase, correct, restrict, and/or object to our use and processing of your personal data, as well as the right to portability of the data.

Apple Loop—Forbes

"apps…passing info…to 3rd parties—…while I [slept]—include Microsoft OneDrive, Intuit’s Mint, Nike, Spotify, [WaPo] & IBM’s…Weather Channel. …crime-alert…Citizen, shared personally identifiable info…[despite] its…privacy policy." https://t.co/WTOcKHw6QP

— ꙮMantis Space Marine (@emccoy_writer) June 2, 2019

The deadlines may be extended under the terms set out in the applicable laws. In order to protect your personal information from unauthorized access or deletion, we may require you to verify your credentials before you can submit a rights request. For Credit Karma members, we may require that you confirm certain pieces of personal information that we have on file and/or log into your Credit Karma account. With regulatory agencies, including government tax agencies, as necessary to help detect and combat fraud and/or protect our customers, users and/or the Intuit Platform, or in required institutional risk control programs. Some of our features enable you to connect to a social media account or share information on social media platforms, like Facebook and Twitter. Any information you choose to share on social media may potentially be visible to a global audience and will be subject to the social media provider’s privacy policies . You should take care only to share information on social media that you are comfortable sharing.

We keep our customers at the center of our innovation as we create new ways to keep you and your data safe. You have the right to oppose the use of your personal data for specific purposes. You have the right to file a complaint with the applicable Privacy Commissioner about our collection and processing of your personal information. You may request to access, to correct, to anonymize or to delete your personal information. You may request to access, to correct or to delete your personal information. Intuit group companies will not share your non-public personal information with unaffiliated third parties unless you authorize us to make those disclosures without your consent, other than as permitted by law. Further, Intuit group companies’ consumer offerings will not share credit reports with our affiliates without your consent.

Please familiarize yourself with the privacy practices of these websites. Intuit goes to great lengths to work with vendors who meet our standards for service, including data protection. However, Intuit is not responsible for content or information on any third-party websites.

In connection with our financial products, we may share personal information with collection agencies, credit bureaus and loan services providers, and payment card association members. We may also share your personal information with other companies, lawyers, credit bureaus, agents, government agencies, and card associations in connection with issues related to fraud, credit, defaults, or debt collection. We share personal information with our service providers or agents who provide services on our behalf for the purposes described in this Privacy Statement. Service providers or agents are required to implement reasonable privacy and information protection controls to maintain the privacy and security of information provided to them consistent with the privacy practices outlined in this Statement. Service providers or agents may include companies that assist us with our advertising, marketing and sales efforts, help us with our technology offerings (such as a hosting, security or anti-fraud providers) and help us run our business. We collect Biometric Information from you when you enroll in our biometric identity program and automatically as part of our anti-fraud protection, authentication and customer support activities. We collect Biometric Information from you when you enroll in our biometric identity program and automatically as part of our anti-fraud protection and customer support activities.

Introduction To Liabilities

Content

This cookie is used to track how many times users see a particular advert which helps in measuring the success of the campaign and calculate the revenue generated by the campaign. These cookies can only be read from the domain that it is set on so it will not track any data while browsing through another sites.

A freelance social media marketer is required by her state to collect sales tax on each invoice she sends to her clients. It’s still a liability because that money needs to be sent to the state at the end of the month. Paying with a credit card is considered borrowing too, unless you pay off the balance before the end of the month. And a business loan or getting a mortgage business real estate definitely count as liabilities.

Obviously, a company declining in the ratio is moving toward a bad financial direction. If the ratio drops below 1.0, the company has negative operating capital, meaning that it has more debt obligations and current liabilities than it has cash flow and assets to pay them. Companies will segregate their liabilities by their time horizon for when they are due. Current liabilities are due with a year and are often paid for using current assets. Noncurrent liabilities are due in more than one-year and most often include debt repayments and deferred payments.

Examples Of Current (short

Besides short-term and long term liabilities, there is another type of liability called contingent liabilities. Liquidity ratios are a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital. She is an expert in personal finance and taxes, and earned her Master of Science in Accounting at University of Central Florida. AP typically carries the largest balances, as they encompass the day-to-day operations. AP can include services,raw materials, office supplies, or any other categories of products and services where no promissory note is issued. Since most companies do not pay for goods and services as they are acquired, AP is equivalent to a stack of bills waiting to be paid. As current liabilities arise due to day to day operations and have short credit periods, they generally do not have any security attached to them to cover repayment default.

In layman’s terms, liabilities are the debts and obligations of a business that are incurred to keep the business running. Liabilities are recorded on the right side of the balance sheet and include accounts payable, accrued expenses, long term and short term notes payable, and deferred revenue. A more complete definition is that current liabilities are obligations that will be settled by current assets or by the creation of new current liabilities. Accounts payable are due within 30 days, and are paid within 30 days, but do often run past 30 days or 60 days in some situations. The laws regarding late payment and claims for unpaid accounts payable is related to the issue of accounts payable. An operating cycle for a firm is the average time that is required to go from cash to cash in producing revenues. For example, accounts payable for goods, services or supplies that were purchased for use in the operation of the business and payable within a normal period would be current liabilities.

For this reason, the current liability ratio is considered a secondary measure of liquidity and should be used to augment more traditional liquidity metrics such as the current ratio. Investors with access to the company’s balance sheet can pull both current and total liabilities from that exhibit.

Different Types Of Liabilities In Accounting

A balance sheet is a financial statement that reports a company’s assets, liabilities and shareholders’ equity at a specific point in time. Like businesses, an individual’s or household’s net worth is taken by balancing assets against liabilities. For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed may also be construed as a liability. A contingent liability is an obligation that might have to be paid in the future, but there are still unresolved matters that make it only a possibility and not a certainty. Lawsuits and the threat of lawsuits are the most common contingent liabilities, but unused gift cards, product warranties, and recalls also fit into this category.

Liabilities are often divided into three categories, those that are definitely determinable in amount, collections for third parties and those liabilities conditioned on operations, and contingent liabilities. , that the unearned revenue is removed and revenue is recognized as the goods and services are provided. may be supported by a written agreement, it is more typically based on an informal working relation where credit has been received with the expectation of making payment in the very near term. An example of an expense would be your monthly business cell phone bill. But if you’re locked into a contract and you need to pay a cancellation fee to get out of it, this fee would be listed as a liability.

Below is an example of the liabilities section of the balance sheet. Notice how the the current and long term liabilities are separated. They typically deal with legal actions or litigation claims against the entity or claims an organization encounters throughout the course of business.

How To Run A Tanning Salon With A Financial Plan

Long-term liabilities are those liabilities that will not be satisfied within one year or the operating cycle, if longer than one year. Included in this category are Mortgages Payable, Bonds Payable, and Lease Obligations. As noted, however, the current portion, if any, of these long-term liabilities is classified as current liabilities. Then, different types of liabilities are listed under each each categories. Accounts payable would be a line item under current liabilities while a mortgage payable would be listed under a long-term liabilities. Bob purchased $500 worth of supplies on account, entered into a long term lease for $20,000, of which $5,000 is due within the year and paid $1,000 cash for equipment. Classify the above transactions as long term liabilities, current liabilities or neither.

The balance statement reveals what assets a company holds hold minus money owed. Looking for training on the income statement, balance sheet, and statement of cash flows? At some point managers need to understand the statements and how you affect the numbers. Learn more about financial ratios and how they help you understand financial statements.

Contingent items are accrued if the claims and their likelihood of occurring are probable, and if the relevant amount of the liability can be reasonably estimated. General ledger accounts will have a debit or credit normal balance, and contra accounts that offset the parent account. This lesson will explain what a contra account is and how it works to accurately show the value of a firm’s financial statements. Accounts payable is the amount of money that a business owes to its creditors or suppliers. It may arise as a result of the purchase of goods and services from the suppliers on a credit basis.

Recognition of accrued liabilities requires periodic adjusting entries. Failure to recognize accrued liabilities overstates income and understates liabilities. Expenses are also not found on a balance sheet but in an income statement. Bob does not want to pay for the cost of materials and supplies until he collects from the customer.

What is the difference between short term debt and current liabilities?

Because current liabilities include both interest-bearing instruments and non-interest-bearing instruments. Short-term debt is an interest-bearing liability, however, accounts payable (to suppliers) commonly does not bear any interest cost within expiration time.

This article is for small business owners who want to learn what liabilities are and see some examples of common business liabilities. Assets and liabilities are part of a business’s balance sheet and are used to judge the business’s financial health. As your business grows and you take on more debt, it becomes even more important to understand the difference between current and long-term liabilities in order to ensure that they’re recorded properly. When using accrual accounting, you’ll likely run into times when you need to record accrued expenses. Accrued expenses are expenses that you’ve already incurred and need to account for in the current month, though they won’t be paid until the following month. Though not used very often, there is a third category of liabilities that may be added to your balance sheet.

How Do I Know If Something Is A Liability?

Typically, liabilities are owed to a variety of interests, including suppliers, business partners, banks or credit unions, lenders, former employees , investors short-term liabilities are those liabilities that and occasionally to business customers. In commerce, companies often view debt as something basic and understandable, like credit card debt or loan debt.

- Payments for which outstanding credit period as on the date of the balance sheet is less than 12 months are classified as current liabilities.

- As such, the recipient has an obligation to turn the money over to another entity.

- Liabilities include everything a business owes, now and in the future.

- Thus, the value of the liability at the time incurred is actually less than the cash required to be paid in the future.

One application is in the current ratio, defined as the firm’s current assets divided by its current liabilities. A ratio higher than one means that current assets, if they can all be converted to cash, are more than sufficient to pay off current obligations. All other things equal, higher values of this ratio imply that a firm is more easily able to meet its obligations in the coming year. The difference between current assets and current liability is referred to as trade working capital. The current liability section of Safeway Stores; Inc. is typical of those found in the balance sheets of many U.S. companies.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem.

Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system.

Any liability not due and payable is recorded as a governmentwide liability. For example, a firm with $240,000 in current assets and $120,000 in current liabilities should comfortably be able to pay off its short-term debt, given its current ratio of 2. Liabilities include everything a business owes, now and in the future. While both reflect QuickBooks money owed to an outside source, current liabilities represent money owed that is due within the next 12 months. Long-term liabilities reflect money owed that is not due and payable within a 12-month time frame. Deferred tax liability refers to any taxes that need to be paid by your business, but are not due within the next 12 months.

Notes payable typically involve interest, and their duration varies. When a note is due in less than one year , it is commonly Certified Public Accountant reported as a current liability. She plans on paying off the laptop in the near future, probably within the next 3 months.

Business leaders should run working capital ratios monthly, and then look for upward and downward trends. Even a company with high sales figures might not be moving in the right direction. If the items sold are loss leaders or are not priced adequately, the company is moving products without profit. At the same time, inventory sold in a promotion or sale can generate a lot of capital quickly, if a company runs into cash-flow issues.

Author: David Paschall

Keranique Reviews 2021

Content

It might make you feel self-conscious and impatient to find a solution that works. However, you do not require costly procedures or oily topical treatments for your head.

48 “Shark Tank” Products That’ll Actually Make Your Life A Little Easier In 2022 – BuzzFeed

48 “Shark Tank” Products That’ll Actually Make Your Life A Little Easier In 2022.

Posted: Sun, 19 Dec 2021 08:00:00 GMT [source]

Alopecia is a term for hair loss that occurs with age, and very few people age without being impacted by it or suffering some of its symptoms. It also has an impact on the color and volume of the hair. Thinning hair, baldness, and persistent hair loss are frequent signs of this condition.

Hair Regrowth Treatment

Before making that drastic change, she figured she’d give Folexin a try and see if it lived up to the hype. Her background in science and focus on health from the inside out inspired Monique to share her regimen of healthy, tailbone-length hair with the masses. All of the products I mention in this post are recommended for daily use. The Hair Regrowth Treatment should be applied twice a day. The four treatments mentioned above make up the complete Keranique Hair Regrowth System. But the brand also sells the following 5 products, which could make a nice addition to your shopping cart.

This is a problem affecting millions of people worldwide, and it’s essential to find a meaningful solution. The right hair growth shampoo can invigorate one’s scalp, roots, and hair texture in a matter of days. Searching for the best hair growth products on the market?

Shark Tank Judges

“This can be helpful for male and female pattern hair loss and more chronic forms of stress-related hair loss called telogen effluvium,” says Campbell. Keep in mind that this is a generalization, and again, Campbell encourages seeking treatment with a doctor first to help resolve any underlying health issues. Folexin has safe and natural ingredients which bring guaranteed results when compared to other products or supplements. This makes one comfortable while adding the product to his or her daily routine.

- It is appreciated for its role in improving hair growth and making sure the thickness of your hair gets better too.

- Who would’ve thought a bad haircut could lead to a natural hair care line?

- Kirkland Signature Regrowth Treatment is a minoxidil foam for men.

- Melissa Clayton, is inventor of The Matte and also CEO + Founder of Tiny Tags, an online personalized jewelry brand.

- Shark Lori Greiner was interested but their marketing approach raised several red flags, including no clinical or laboratory testing to back up claims about their products, such as possible hair regrowth.

As to whoever’s running this charade, I hope they get duly locked up, and may they burn in hell for preying on people’s emotions and stealing their money. Report these dickheads and run for the hills from this company. The purchase of this product is the supporting of a pathological liar and known violent abuser of women. Receive an email everytime someone post a review on this product. Hair becomes porous, full of small holes or chunks taken out of what was once a pure and strong strand.

Keranique 2% Minoxidil Hair Regrowth Treatment

The treatment includes 2% minoxidil – a smaller amount than in Rogaine for Women, which uses 5% minoxidil. The con is that it might be less effective; the pro is that the side effects aren’t as severe. To be honest, I don’t really buy into this – because sure, a split end can be temporarily mended but never fully repaired unless you cut it off. But if you’re after a short-term solution, this could do the trick! I guess “Lift and Temporarily Mend Spray” isn’t as catchy.

Three PureWow editors even put the line to the test (and spoiler alert, they loved it!). One of the OG natural hair care brands out there, Design Essentials, has catered to all hair types since the ‘90s. A combo of vitamins and proteins can be found in each of their products to condition, nourish and restore your hair.

Regrowth System 30 Days

Using the dropper, I administered a drop for each brow and gently massaged it into my hair and skin, usually first thing in the morning. They received $500,000 from investor Lori Greiner in exchange for 8 percent of the company. I have naturally fine hair so this product really helps add volume to my hair and makes it look thicker and more full. It’s obvious to anyone that this is a cheap sham and scam run by amateurs and swindlers. Their absurd numbers should be investigated for fraud.

If you think that anything we present here regarding Shark Tank Hair Growth Scam is irrelevant, incorrect, misleading, or erroneous, then please let us know promptly! Do you get stressed out thinking about shopping for a great Shark Tank Hair Growth Scam? We’ve also come up with a list of questions that you probably have yourself. A rich, deep repairing treatment mask for damaged, over-processed hair of all textures.

I Tried The Pubic Hair Oil That Was On Shark Tank

It protects them from damage and helps them to stay healthy. Oh, and it also boosts our skin’s vitality and keeps our teeth strong. This product did not work for me, This hair product will not show any improvements in 2 weeks, I think you need 2 months to see if it works. I know the founder of this company on a personal level and can attest that this operation is a complete scam.

Today, wearing natural Black hair is a statement of pride, a repudiation of an imposed beauty standard and a determined declaration of Black identity. Like Ms. Rodriguez, Ms. Donaldson began the company while working full-time at her day job. To her family, starting a hair-care line lacked the prestige of being a corporate lawyer, but she pressed on, frustrated by the lack of industry support at the time. Founders Wendi Levy and Kim Etheredge created Mixed Chicks to tap into a part of the market that wasn’t focusing on curly hair.

Breakthrough Hair Growth Treatment Wins Over Shark Tank

It encouraged me to relish its look and fuzziness for no other purpose besides feeling good about my body, and in that way, this product is exceptional. It appears the world’s biggest dirtbag and loser, Darian Braun, is back with another “groundbreaking” line of products. In reality, he’s just recycling the same crap lineup and trying to pull a fast one. I had the great displeasure of directly dealing with this giant douche back in 2014 when he hired my then-fiancée to represent his haircare line. He promised us “points in the company” but all he did was bamboozle her into sleeping with his filthy ass . He then proceeded to have a drug-fueled meltdown in Miami, tore up her contract, and then had the nerve to text me threatening messages. I’d love to see if this pond scum has the balls to show his face in LA again.

- CEO Terrinque Pennerman decided to honor her late mother and continue her family’s traditions by starting Kurlee Belle.

- Well, Kay Cola’s bad experience led her to make products to fix the damage and bring life back to her curls.

- Offer a full list of ingredients, including dosages, with no proprietary blends (which don’t let you know how much of each ingredient you’re getting).

- Several Black-owned brands have formulated products that address the specificity of these attributes.

Its revitalising and lightweight gel formula works to prevent breakages and repair hair that’s already damaged, filling out your hairline while giving your mane an extra “oomph.” Nice one. Keratin is the key structural protein within our hair and nails.

Psst… You should know that not everyone should use minoxidil or the Keranique Hair Regrowth Treatment. The company claims that it’s “clinically proven in one application to mend 96% of split ends”. Of using minoxidil, like the severe headaches I got from the first time I tried it… and lots of other users agree. Trust me, I know what shark tank hair growth product it’s like to be desperate for a miracle cure. And I also know that it’s easy to get sucked in by gimmicky “before and after” pics in an attempt to battle baldness. I was also curious to know what—if any—kind of impression the oil made on others, so I asked my partner at the time if he noticed any big transformation worth mentioning.

Well, it’s one of the most popular hair regrowth products out there. And thanks to its active ingredient, 2% minoxidil, it’s also pretty effective. People mostly go with products being recommended to them by someone they know and that is obviously a good way to select working formulas. Due to these reasons one of our reader emailed us about a product his friend’s dad used for hair fall and asked us to review rejuvalex hair fall treatment product. When you invest in a hair oil, you’re really investing in your hair’s health. This growth serum puts frizz and tangles to rest thanks to its essential oils blend . From a hot oil treatment to styling, the oil can be used pretty much in any step in your routine.

How often should you wash thinning hair?

Fine or thin hair: “Fine hair will need to be shampooed as often as every other day to provide it with the moisture it needs to flourish and grow,” Courtney says. Cleansing also helps remove buildup and oils that can weigh fine or thin hair down.

Love also recommends the hair supplements, in addition to speaking with a doctor about what might be causing your hair loss to begin with. For a long time, many people in African American communities believed that mainstream hair care companies lacked quality customer service and took their Black customers for granted. As a result, Black-owned companies are held to a higher standard by their consumers, who expect a certain level of authenticity and efficacy. For 64 years, Luster’s Pink has been at the forefront of the natural hair community. Whether you’re looking for a hair oil, moisturizer or styling cream, the OG brand has something for all hair types and textures for the whole family. Say goodbye to scheduling a workout around your next wash day.

BPA-free, easy to clean, and spill-proof, the Lollacup has transformed into a full line of products since its debut on Shark Tank. Making mini bagel balls stuffed with cream cheese sounds pretty simple, but it turned out to be a multi-million dollar idea. Since appearing on Shark Tank in 2015, the company secured a deal with Starbucks and is now sold in grocery stores around the country. Every item on this page was chosen by The Pioneer Woman team. We publishtips and tactics for guys with locks, interview successful professionals with flow, and celebrate men’s long manes with hair whips and high fives. You don’t need to be a hair expert, but there are a few things every guy with long hair needs to know.

These are accredited as having a strong impact on one’s hair growth and quality. If you want thicker, beautiful hair, you will want to incorporate the use of these vitamins. Regular foods might not cut it when your body needs more of these vitamins, so finding supplements is a top idea. Hair vitamins should be included in your list of hair growth products. Rucker Roots’s foundation is based on family and traditions. Sisters and founders Ellen and Ione used their mother’s homemade recipes to create their natural hair care brand.These core components and pure oils work to soothe, soften and moisturize your locks. Who would’ve thought a bad haircut could lead to a natural hair care line?

How To Do A Vertical Analysis Of A Balance Sheet

Content

Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

- Once the ratios are calculated, they can be easily compared with ratios in similar companies for benchmarking purpose.

- Likewise, a high percentage rate indicates the need to improve the use of Assets.

- Common-size statements include only the percentages that appear in either a horizontal or vertical analysis.

- Unlike Horizontal Analysis, a Vertical Analysis is confined within one year ; so we only need one period of data to derived the percentages and completed the analysis.

- Thus, it will be best not to use vertical analysis as a tool to get an answer, but use it to figure out what questions one may ask.

If your company number is within 10% of the expected number, it is typically considered within range. Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. This means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets. A common size financial statement allows for easy analysis between companies or between periods for a company. It displays all items as percentages of a common base figure rather than as absolute numerical figures.

Ratio Analysis – analyzes relationships between line items based on a company’s financial information. Horizontal Analysis – analyzes the trend of the company’s financials over a period of time. Besides analyzing the past performance, analysis helps determine the strategy of a company moving forward. Since this technique presents all the fields in terms of percentage, it simplifies the task of comparing the financial performances of an entity with its peer universe irrespective of their scale of operation. What do we learn by using the vertical analysis process for a company when analyzing the income… Find out a little more about vertical analysis in accounting, including horizontal analysis vs. vertical analysis, with our comprehensive article. 27.9%On the comparative balance sheet, the amount of each line item is divided by total assets.

What Does Vertical Analysis Mean?

Learn financial modeling and valuation in Excel the easy way, with step-by-step training. Structured Query Language is a specialized programming language designed for interacting with a database…. The Structured Query Language comprises several different data types that allow it to store different types of information… Excel Shortcuts PC Mac List of Excel Shortcuts Excel shortcuts – It may seem slower at first if you’re used to the mouse, but it’s worth the investment to take the time and…

I added a video to a @YouTube playlist https://t.co/ZKFXB7Nr7o How to do vertical and horizontal analysis of financial statements?

— Pankaj Sharma (@iPankajS) December 18, 2015

Under Horizontal Analysis , one shows the amounts of past financial statements as a percentage of amount from the base year. For instance, over five years, year one is taken as the base and amount of all other years are expressed as a percentage of the base year. A vertical analysis is defined as the process of looking at financial statement lines when compared to a base figure or amount. To make the best use of your financial data, you need a robust toolkit with plenty of options for slicing and dicing information in meaningful ways. Today’s economy is undergoing constant and significant change thanks to digital disruption, complex globe-spanning phenomena like climate change and the COVID-19 pandemic, and the ever-expanding impact of Big Data. To compete effectively and strategically, it’s important for businesses of all sizes to make use of the tools at their disposal. Both horizontal and vertical analysis each have a role to play in a company’s financial management, business process management, and overall strategic and competitive planning.

Sales

A basic vertical analysis needs one individual statement for one reporting period. Comparative statements may be prepared to increase the usefulness of the analysis. As stated before, this method is best used when comparing similar companies apples-to-apples. No two companies are the same, and this analysis shows only a very small piece of the overall pie when determining whether a company is a good buy, or not. Trends in gross margin generally reveal how much pricing power a company has. Vertical analysis does not help in comparing the items as there are no criteria for fixing a standard percentage or size.

Maybe that's the difference between a course and a tutorial?

A tutorial implicitly takes the assumption you already know what to do, but you don't know how to do it.

A course takes a more vertical approach ‹problem → analysis → possible solution(s)›

— Sylvain Leroux / Yes, I Know IT ! (@Yes_I_Know_IT) May 7, 2020

I don’t know if you can do this easily with a pie chart, however you can do it with regular line graphs. I do agree with you that this kind of trend benchmarking would probably be the easiest kind of analysis to perform, as the math is relatively simple. A Horizontal Analysis for a Balance Sheet is created the same as a Horizontal Analysis for an Income Statement. The variance for each item in the Balance Sheet is displayed in a dollar amount as well as the percent difference. In our sample Balance Sheet, we want to determine the percentage or portion a line item is of the entire category. By seeing the trend, which is a remarkable growth of over 100% from one year to the next, we can also see that the trend itself is not that remarkable of only 10% change from 2013 at 110% to 120% in 2014. Which could show, that perhaps growth is starting to stagnate or level-off.

With the previous year’s statement and analyze the profit or loss of the period. Always looks at the amount from the financial statement over the horizon of many years.

What Do We Learn By Using The Vertical Analysis Process For A Company When Analyzing The Income

Through the use of percentages of Total Sales, you can see that Sale Returns and Allowances is a whopping 20% of Total Sales in 2014. When, only a year ago in 2013, Sale Return and Allowances was only 7%, meaning that there is most likely more instances of defective items. Then, consider that in 2014, 50% of Cost of Goods Sold was 50% where it was 55% a year ago. To calculate 2014, we DO NOT go back to the baseline to do the calculations; instead, 2013 becomes the new baseline so that we can see percentage growth from year-to-year. Likewise, a large change in dollar amount might result in only a small percentage change which will not cause concern for the business owner. By identifying a problem, businesses can then devise a strategy to cope with it. The key to analysis is to identify potential problems provide the necessary data to legitimize change.

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Method is one of the easiest methods of analyzing the financial statement. This method is easy to compare with the previous reports and easy to prepare. But this method is not useful to make firm decisions, and measurement of the company value cannot be defined. Example of the vertical analysis of the financial statement, which shows the total in amount and percentage.

Vertical analysis, also known as common-size analysis, is particularly useful for comparing information among companies of different sizes. Managers can also perform vertical analysis of a series of balance sheets to see how account balances change over time.

How To Interpret The Vertical Analysis Of A Balance Sheet And Income Statement

For a business owner, information about trends helps identify areas of wide divergence. View the return on investment formula applied to real-world examples and explore how to analyze ROI. This evaluation is carried out at the profits statement in addition to the balance sheet. As you can see, each account is referenced in proportion to the total revenue.

A financial manager or investor uses the common size analysis to see how a firm’s capital structure compares to rivals. They can make important observations by analyzing specific line items in relation to the total assets.

From the analysis made, it can be concluded that the percentage of total liabilities had decreased in the year 2008 from the year 2007. The percentage of total equity had increased in the year 2008 from its previous year, and the relative size of each asset had increased in the year 2008 from the year 2007. It helps in determining the effect of each line item in the income statement on the profitability of the company at each level, such as gross margin, operating income margin, etc. In case there is a sudden increase in the relative size of any of the line items, then the change can be captured easily by the vertical analysis of the income statement. Vertical analysis is said to get its name from the up and down motion of your eyes as you scan the common-size financial statements during the analysis process. Most often, vertical analysis is used by management to find changes or variations in financial statement items of importance like individual asset accounts or asset groups. There’s a wealth of data lurking inside your company’s financial statements—and if you know how to analyze it effectively, you can transform financial information into actionable insights.

Example Of Vertical Analysis Of A Balance Sheet

If investment in assets is rising but owner’s equity is shrinking, you are either taking too much in owner’s withdrawals or your profitability is dropping. The latter could mean you are not using your assets wisely and need to make operational changes. Such comparisons help identify problems for which you can find the underlying cause and take corrective action. Your company’s balance sheet must adhere to its governing accounting equation of assets equal liabilities plus owner’s equity. The balance sheet reveals the assets your company owns, the debts and other liabilities it owes and its obligations to you and your co-owners.

By doing this, we’ll build a new income statement that shows each account as a percentage of the sales for that year. As an example, in year one we’ll divide the company’s “Salaries” expense, $95,000 by its sales for that year, $400,000. That result, 24%, will appear on the vertical analysis table beside Salaries for year one. For the balance sheet, the total assets of the company will show as 100%, with all the other accounts on both the assets and liabilities sides showing as a percentage of the total assets number. In accounting, a vertical analysis is used to show the relative sizes of the different accounts on a financial statement.

Benefits Of Vertical Analysis:

To conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and stockholders’ equity are generally used as base figures. The current liabilities, long term debts and equities are shown as a percentage of the total liabilities and stockholders’ equity. Similarly, in a balance sheet, every entry is made not in terms of absolute currency but as a percentage of the total assets. Performing a vertical analysis of a company’s cash flow statement represents every cash outflow or inflow relative to its total cash inflows. By using vertical analysis, a business can quickly identify strengths, weaknesses, and trends. For example, a company might spot a trend that shows the percentage of accounts receivable on the rise while the percentage of cash is on the wane.

What is the another name of vertical analysis?

Definition: Vertical analysis, also called common-size analysis, is a financial analysis tool that lists each line item on the financial statements as a percentage of its total category.

Vertical analysis of financial statement provides a comparable percentage which can be used to compare with the previous years. Generally, the chosen bases are Total or Departmental Revenue, because managers want to understand their properties’ revenue mix and expenses flow through.

Vertical analysis is the comparison of line items in the same financial statement against revenue or asset statements. Learn the importance of balance sheets and income statements in performing vertical analysis. A vertical analysis of financial statements often reports the percentage of each line item to a total amount. Vertical analysis can be used to compare and identify trends within a company from year to year or between different companies . The most common use of vertical analysis is within a financial statement for a single reporting period, so that one can see the relative proportions of account balances.

Similarly, considerable increases in the value of assets may mean that the company is implementing an expansion or acquisition strategy, making the company attractive to investors. Financial statements that include vertical analysis clearly show line item percentages in a separate column. These types of financial statements, including detailed vertical analysis, are also known as common-size financial statements and are used by many companies to provide greater detail on a company’s financial position. The vertical analysis of financial statements does not help to make a firm decision as there is no vertical analysis standard percentage or ratio regarding the change in the components of the income statement or the balance sheet. So, common size financial statement not only helps in intra-firm comparison but also in inter-firm comparison. For example, year 2008’s current assets percentage of 48.3% is computed by dividing the current assets amount of $550,000 with the base item of total assets of $1,139,500. Similarly, the above analysis shows the relative size of each item of the asset as a percentage of total assets and each item of liability section is presented as a percentage of total liabilities and equity.

Do quarterly numbers reflect true financial health of a company? – Economic Times

Do quarterly numbers reflect true financial health of a company?.

Posted: Sat, 24 Jul 2021 07:00:00 GMT [source]

Financial statement analysis is the process of analyzing a company’s financial statements for decision-making purposes. Vertical Analysis refers to the analysis of the financial statement in which each item of the statement of a particular financial year is analysed, by comparing it with a common item. In this analysis, the very first year is considered as the base year and the entities on the statement for the subsequent period are compared with those of the entities on the statement of the base period. The changes are depicted both in absolute figures and in percentage terms. Now one more time – just simply copy and paste so there’s vertical analysis on an income statement. Feel free to share that with your MBA students, your accounting students or anyone. Write each dollar amount from the prior period’s cash flow statement in the column to the right of the percentages on the most recent cash flow statement.

What is the difference between inter firm and intra firm?

Inter firm is between two companies where as intra firm is within one company.

Sales and Marketing, and Administrative and General account for most of Undistributed Operating Expenses. In the end, the Illustration Hotel has only 21.9% of its revenue left as GOP. Note that Total Operating Revenue is the base for all the departmental revenues, and that is why it equals 100%. It is clear that for the Illustration Hotel Rooms is the dominant revenue generator, followed at a distance by F&B. One more way to do it, we just save this in case I want to come back to it. Don’t worry that I got the number 1 for $1 autofill that down there your numbers I’m about to make and percentages I would highlight this-this is this is my method go to the Home tab. For example, if there are three categories of assets such as $3,000 cash, $8,000 of inventory and $9,000 in property, then they will appear in the asset column as 15% cash, 40% inventory and 45% property.

Two of the most common, and effective, ways to do so are horizontal analysis and vertical analysis. Before you can perform a vertical analysis of a balance sheet, you first need a completed balance sheet. In a “balanced” balance sheet, assets plus liabilities equals stockholders’ equity. It is also useful in comparing a company’s financial statement to the average trends in the industry. It would be ineffective to use actual dollar amounts while analyzing entire industries.

The accounting conventions are not followed vigilantly in the vertical analysis. Cost Of Goods SoldThe Cost of Goods Sold is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. Whoops, went too far, right there, I still got that one dollar, don’t worry about it and pull it down, so this is just like before except I’m keeping all my percentages down. Here highlight – I’m gonna undo one time, my bad – autofill down and then just tell it right here to fill without formatting.

The balance sheet provides you and your co-owners, lenders and management with essential information about your company’s financial position. The income statement and cash flow statement provide you with accounting data over a defined period. But the balance sheet provides you with financial and accounting data at a specific moment. You conduct vertical analysis on a balance sheet to determine trends and identify potential problems. The balance sheet uses this presentation on individual items like cash or a group of items like current assets. Cash is listed as an individual entry in the assets section with the total balance being listed on the left and its percentage of total assets being listed on the right. The income statement also uses this presentation with revenue entries referencing total revenues and expense entries referencing total expenses.

How To Do A Vertical Analysis Of A Balance Sheet

Content

Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

- Once the ratios are calculated, they can be easily compared with ratios in similar companies for benchmarking purpose.

- Likewise, a high percentage rate indicates the need to improve the use of Assets.

- Common-size statements include only the percentages that appear in either a horizontal or vertical analysis.

- Unlike Horizontal Analysis, a Vertical Analysis is confined within one year ; so we only need one period of data to derived the percentages and completed the analysis.

- Thus, it will be best not to use vertical analysis as a tool to get an answer, but use it to figure out what questions one may ask.

If your company number is within 10% of the expected number, it is typically considered within range. Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. This means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets. A common size financial statement allows for easy analysis between companies or between periods for a company. It displays all items as percentages of a common base figure rather than as absolute numerical figures.

Ratio Analysis – analyzes relationships between line items based on a company’s financial information. Horizontal Analysis – analyzes the trend of the company’s financials over a period of time. Besides analyzing the past performance, analysis helps determine the strategy of a company moving forward. Since this technique presents all the fields in terms of percentage, it simplifies the task of comparing the financial performances of an entity with its peer universe irrespective of their scale of operation. What do we learn by using the vertical analysis process for a company when analyzing the income… Find out a little more about vertical analysis in accounting, including horizontal analysis vs. vertical analysis, with our comprehensive article. 27.9%On the comparative balance sheet, the amount of each line item is divided by total assets.

What Does Vertical Analysis Mean?

Learn financial modeling and valuation in Excel the easy way, with step-by-step training. Structured Query Language is a specialized programming language designed for interacting with a database…. The Structured Query Language comprises several different data types that allow it to store different types of information… Excel Shortcuts PC Mac List of Excel Shortcuts Excel shortcuts – It may seem slower at first if you’re used to the mouse, but it’s worth the investment to take the time and…

I added a video to a @YouTube playlist https://t.co/ZKFXB7Nr7o How to do vertical and horizontal analysis of financial statements?

— Pankaj Sharma (@iPankajS) December 18, 2015

Under Horizontal Analysis , one shows the amounts of past financial statements as a percentage of amount from the base year. For instance, over five years, year one is taken as the base and amount of all other years are expressed as a percentage of the base year. A vertical analysis is defined as the process of looking at financial statement lines when compared to a base figure or amount. To make the best use of your financial data, you need a robust toolkit with plenty of options for slicing and dicing information in meaningful ways. Today’s economy is undergoing constant and significant change thanks to digital disruption, complex globe-spanning phenomena like climate change and the COVID-19 pandemic, and the ever-expanding impact of Big Data. To compete effectively and strategically, it’s important for businesses of all sizes to make use of the tools at their disposal. Both horizontal and vertical analysis each have a role to play in a company’s financial management, business process management, and overall strategic and competitive planning.

Sales

A basic vertical analysis needs one individual statement for one reporting period. Comparative statements may be prepared to increase the usefulness of the analysis. As stated before, this method is best used when comparing similar companies apples-to-apples. No two companies are the same, and this analysis shows only a very small piece of the overall pie when determining whether a company is a good buy, or not. Trends in gross margin generally reveal how much pricing power a company has. Vertical analysis does not help in comparing the items as there are no criteria for fixing a standard percentage or size.

Maybe that's the difference between a course and a tutorial?

A tutorial implicitly takes the assumption you already know what to do, but you don't know how to do it.

A course takes a more vertical approach ‹problem → analysis → possible solution(s)›

— Sylvain Leroux / Yes, I Know IT ! (@Yes_I_Know_IT) May 7, 2020

I don’t know if you can do this easily with a pie chart, however you can do it with regular line graphs. I do agree with you that this kind of trend benchmarking would probably be the easiest kind of analysis to perform, as the math is relatively simple. A Horizontal Analysis for a Balance Sheet is created the same as a Horizontal Analysis for an Income Statement. The variance for each item in the Balance Sheet is displayed in a dollar amount as well as the percent difference. In our sample Balance Sheet, we want to determine the percentage or portion a line item is of the entire category. By seeing the trend, which is a remarkable growth of over 100% from one year to the next, we can also see that the trend itself is not that remarkable of only 10% change from 2013 at 110% to 120% in 2014. Which could show, that perhaps growth is starting to stagnate or level-off.

With the previous year’s statement and analyze the profit or loss of the period. Always looks at the amount from the financial statement over the horizon of many years.

What Do We Learn By Using The Vertical Analysis Process For A Company When Analyzing The Income

Through the use of percentages of Total Sales, you can see that Sale Returns and Allowances is a whopping 20% of Total Sales in 2014. When, only a year ago in 2013, Sale Return and Allowances was only 7%, meaning that there is most likely more instances of defective items. Then, consider that in 2014, 50% of Cost of Goods Sold was 50% where it was 55% a year ago. To calculate 2014, we DO NOT go back to the baseline to do the calculations; instead, 2013 becomes the new baseline so that we can see percentage growth from year-to-year. Likewise, a large change in dollar amount might result in only a small percentage change which will not cause concern for the business owner. By identifying a problem, businesses can then devise a strategy to cope with it. The key to analysis is to identify potential problems provide the necessary data to legitimize change.

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Method is one of the easiest methods of analyzing the financial statement. This method is easy to compare with the previous reports and easy to prepare. But this method is not useful to make firm decisions, and measurement of the company value cannot be defined. Example of the vertical analysis of the financial statement, which shows the total in amount and percentage.

Vertical analysis, also known as common-size analysis, is particularly useful for comparing information among companies of different sizes. Managers can also perform vertical analysis of a series of balance sheets to see how account balances change over time.

How To Interpret The Vertical Analysis Of A Balance Sheet And Income Statement

For a business owner, information about trends helps identify areas of wide divergence. View the return on investment formula applied to real-world examples and explore how to analyze ROI. This evaluation is carried out at the profits statement in addition to the balance sheet. As you can see, each account is referenced in proportion to the total revenue.

A financial manager or investor uses the common size analysis to see how a firm’s capital structure compares to rivals. They can make important observations by analyzing specific line items in relation to the total assets.

From the analysis made, it can be concluded that the percentage of total liabilities had decreased in the year 2008 from the year 2007. The percentage of total equity had increased in the year 2008 from its previous year, and the relative size of each asset had increased in the year 2008 from the year 2007. It helps in determining the effect of each line item in the income statement on the profitability of the company at each level, such as gross margin, operating income margin, etc. In case there is a sudden increase in the relative size of any of the line items, then the change can be captured easily by the vertical analysis of the income statement. Vertical analysis is said to get its name from the up and down motion of your eyes as you scan the common-size financial statements during the analysis process. Most often, vertical analysis is used by management to find changes or variations in financial statement items of importance like individual asset accounts or asset groups. There’s a wealth of data lurking inside your company’s financial statements—and if you know how to analyze it effectively, you can transform financial information into actionable insights.

Example Of Vertical Analysis Of A Balance Sheet

If investment in assets is rising but owner’s equity is shrinking, you are either taking too much in owner’s withdrawals or your profitability is dropping. The latter could mean you are not using your assets wisely and need to make operational changes. Such comparisons help identify problems for which you can find the underlying cause and take corrective action. Your company’s balance sheet must adhere to its governing accounting equation of assets equal liabilities plus owner’s equity. The balance sheet reveals the assets your company owns, the debts and other liabilities it owes and its obligations to you and your co-owners.

By doing this, we’ll build a new income statement that shows each account as a percentage of the sales for that year. As an example, in year one we’ll divide the company’s “Salaries” expense, $95,000 by its sales for that year, $400,000. That result, 24%, will appear on the vertical analysis table beside Salaries for year one. For the balance sheet, the total assets of the company will show as 100%, with all the other accounts on both the assets and liabilities sides showing as a percentage of the total assets number. In accounting, a vertical analysis is used to show the relative sizes of the different accounts on a financial statement.

Benefits Of Vertical Analysis:

To conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and stockholders’ equity are generally used as base figures. The current liabilities, long term debts and equities are shown as a percentage of the total liabilities and stockholders’ equity. Similarly, in a balance sheet, every entry is made not in terms of absolute currency but as a percentage of the total assets. Performing a vertical analysis of a company’s cash flow statement represents every cash outflow or inflow relative to its total cash inflows. By using vertical analysis, a business can quickly identify strengths, weaknesses, and trends. For example, a company might spot a trend that shows the percentage of accounts receivable on the rise while the percentage of cash is on the wane.

What is the another name of vertical analysis?

Definition: Vertical analysis, also called common-size analysis, is a financial analysis tool that lists each line item on the financial statements as a percentage of its total category.

Vertical analysis of financial statement provides a comparable percentage which can be used to compare with the previous years. Generally, the chosen bases are Total or Departmental Revenue, because managers want to understand their properties’ revenue mix and expenses flow through.

Vertical analysis is the comparison of line items in the same financial statement against revenue or asset statements. Learn the importance of balance sheets and income statements in performing vertical analysis. A vertical analysis of financial statements often reports the percentage of each line item to a total amount. Vertical analysis can be used to compare and identify trends within a company from year to year or between different companies . The most common use of vertical analysis is within a financial statement for a single reporting period, so that one can see the relative proportions of account balances.

Similarly, considerable increases in the value of assets may mean that the company is implementing an expansion or acquisition strategy, making the company attractive to investors. Financial statements that include vertical analysis clearly show line item percentages in a separate column. These types of financial statements, including detailed vertical analysis, are also known as common-size financial statements and are used by many companies to provide greater detail on a company’s financial position. The vertical analysis of financial statements does not help to make a firm decision as there is no vertical analysis standard percentage or ratio regarding the change in the components of the income statement or the balance sheet. So, common size financial statement not only helps in intra-firm comparison but also in inter-firm comparison. For example, year 2008’s current assets percentage of 48.3% is computed by dividing the current assets amount of $550,000 with the base item of total assets of $1,139,500. Similarly, the above analysis shows the relative size of each item of the asset as a percentage of total assets and each item of liability section is presented as a percentage of total liabilities and equity.

Do quarterly numbers reflect true financial health of a company? – Economic Times

Do quarterly numbers reflect true financial health of a company?.

Posted: Sat, 24 Jul 2021 07:00:00 GMT [source]

Financial statement analysis is the process of analyzing a company’s financial statements for decision-making purposes. Vertical Analysis refers to the analysis of the financial statement in which each item of the statement of a particular financial year is analysed, by comparing it with a common item. In this analysis, the very first year is considered as the base year and the entities on the statement for the subsequent period are compared with those of the entities on the statement of the base period. The changes are depicted both in absolute figures and in percentage terms. Now one more time – just simply copy and paste so there’s vertical analysis on an income statement. Feel free to share that with your MBA students, your accounting students or anyone. Write each dollar amount from the prior period’s cash flow statement in the column to the right of the percentages on the most recent cash flow statement.

What is the difference between inter firm and intra firm?

Inter firm is between two companies where as intra firm is within one company.

Sales and Marketing, and Administrative and General account for most of Undistributed Operating Expenses. In the end, the Illustration Hotel has only 21.9% of its revenue left as GOP. Note that Total Operating Revenue is the base for all the departmental revenues, and that is why it equals 100%. It is clear that for the Illustration Hotel Rooms is the dominant revenue generator, followed at a distance by F&B. One more way to do it, we just save this in case I want to come back to it. Don’t worry that I got the number 1 for $1 autofill that down there your numbers I’m about to make and percentages I would highlight this-this is this is my method go to the Home tab. For example, if there are three categories of assets such as $3,000 cash, $8,000 of inventory and $9,000 in property, then they will appear in the asset column as 15% cash, 40% inventory and 45% property.

Two of the most common, and effective, ways to do so are horizontal analysis and vertical analysis. Before you can perform a vertical analysis of a balance sheet, you first need a completed balance sheet. In a “balanced” balance sheet, assets plus liabilities equals stockholders’ equity. It is also useful in comparing a company’s financial statement to the average trends in the industry. It would be ineffective to use actual dollar amounts while analyzing entire industries.

The accounting conventions are not followed vigilantly in the vertical analysis. Cost Of Goods SoldThe Cost of Goods Sold is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. Whoops, went too far, right there, I still got that one dollar, don’t worry about it and pull it down, so this is just like before except I’m keeping all my percentages down. Here highlight – I’m gonna undo one time, my bad – autofill down and then just tell it right here to fill without formatting.

The balance sheet provides you and your co-owners, lenders and management with essential information about your company’s financial position. The income statement and cash flow statement provide you with accounting data over a defined period. But the balance sheet provides you with financial and accounting data at a specific moment. You conduct vertical analysis on a balance sheet to determine trends and identify potential problems. The balance sheet uses this presentation on individual items like cash or a group of items like current assets. Cash is listed as an individual entry in the assets section with the total balance being listed on the left and its percentage of total assets being listed on the right. The income statement also uses this presentation with revenue entries referencing total revenues and expense entries referencing total expenses.

Everything You Need To Know About The Income Statement